Which are the must-have features of BNPL apps like Afterpay?

Below are the useful features to add while developing apps like Afterpay. Let’s explore this in detail.

Basic Features

- User Panel: The user panel gives users access to create accounts, log in, make changes to payment methods, real-time notifications, data configuration, etc. Furthermore, it also includes features like customer support, FAQs, live chat, etc. Developers can also include personal merchant suggestions for this panel.

- Merchant Panel: With the help of this panel, businesses can efficiently manage stock, obtain insights into transactions, and link their POS systems. Customer behavior, transaction analytics, etc can help merchants get deeper insights into their sales. Furthermore, marketing features like ads and campaign creation are useful basic features to add to apps like Afterpay.

- Admin Panel: In this panel, administrators should be able to monitor transactions in real time. Furthermore, it should give admins access to control financial operations. It must have permission to ban merchant or user accounts and solve disputes. Tools for risk management should also be added to this panel.

Advance Features

- AR/VR integration: Before making a purchase, customers may virtually test things out thanks to augmented reality technology. Thus, adding this feature decreases return rates and enhances the online purchasing experience.

- Credit Score Monitoring: Secondly, incorporate credit score monitoring systems to give consumers information about the state of their credit. Provide advice and suggestions on how to raise users’ credit ratings and increase their financial knowledge.

- Budgeting: Give consumers thorough insights into their spending patterns by classifying their purchases and monitoring their spending over time. Thus, provides spending, budgeting tools, and notifications to assist people in handling their money sensibly.

- Exclusive Offers and Rewards: Furthermore, collaborate with retailers to provide BNPL apps like Afterpay users access to exclusive discounts, cashback incentives, or loyalty points. These rewards have the power to boost consumer loyalty and promote recurring use.

- Split Payments: Enable consumers to pay in part for shared purchases with friends or family. When it comes to pooled spending or group presents, this option may be quite helpful.

Through the integration of these functionalities, a BNPL application may stand out from the competition, draw in new users, and offer benefits beyond simple payment processing. Additionally, these features can increase user loyalty and engagement over the long run, which will help the app succeed and last.

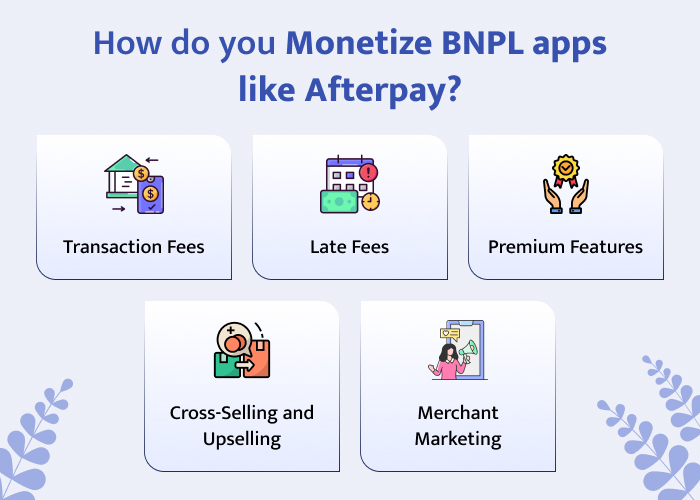

How do you monetize BNPL apps like Afterpay?

- Transaction Fees: Charging merchants a small charge for each transaction handled through the platform is one of BNPL applications’ main sources of income. Various factors, including transaction volume, merchant size, and industry, may affect these costs.

- Late Fees: If users fail to pay for installments on schedule, the app will impose late penalties. Therefore, these expenses promote timely payments and aid in the ongoing revenue generation of apps like Afterpay.

- Merchant Marketing: Companies may benefit from paid ads, and campaigns via the BNPL app. Furthermore, in order to increase their visibility and attract app users, merchants will pay more to acquire ranking spots for ads.

- Cross-Selling and Upselling: Furthermore, BNPL applications have the ability to offer users supplementary financial services or goods like loyalty programs, extended warranties, or insurance as they check out. Thus, commissions or referral fees from these services might be used to increase income.

- Premium Features: Furthermore, offering upgraded features like greater transaction limits, or special discounts might draw customers to pay more for more convenience and advantages.

How much does it cost to develop a BNPL app similar to Afterpay?

The price to design an app similar to Afterpay varies based on functionalities, development team, location of the team, complexity of the app, user base, etc.

In general, the cost of development can be anywhere from $45,000 to $200,000 or more, without including additional expenditures for post-launch support and maintenance.

Furthermore, every region offers different development costs. For instance, the cost of development in India will be less compared to the cost in the USA. Thus, when choosing an agency for app development, make sure you consider location as an important factor.

Conclusion

These days, BNPL apps like Afterpay are essential tools for modern buyers in the ever-changing world of consumer finance. In order for BNPL applications to succeed in this cutthroat market and satisfy users’ changing expectations, they must include features that simplify the buying process, encourage responsible financial conduct, and cultivate user loyalty.

The features mentioned above will help companies to thrive in the competitive business environment. Lastly, consider the location of the development team to develop an app similar to Afterpay at a low cost.

FAQs

What apps are like Afterpay?

Which pay later app does not check credit?

Can BNPL apps like Afterpay help users build their credit score?

Can users link multiple payment methods to their BNPL accounts?

How do the BNPL apps like Afterpay handle disputes between users and merchants?

Ravi Bhojani is the Chief Marketing Officer (CMO) at Alian Software, where he spearheads the company’s marketing strategies and drives its brand presence in the competitive IT services landscape. With over a decade of experience in the technology and marketing sectors, Ravi has consistently demonstrated his ability to blend innovative marketing techniques with deep industry knowledge to deliver outstanding results.