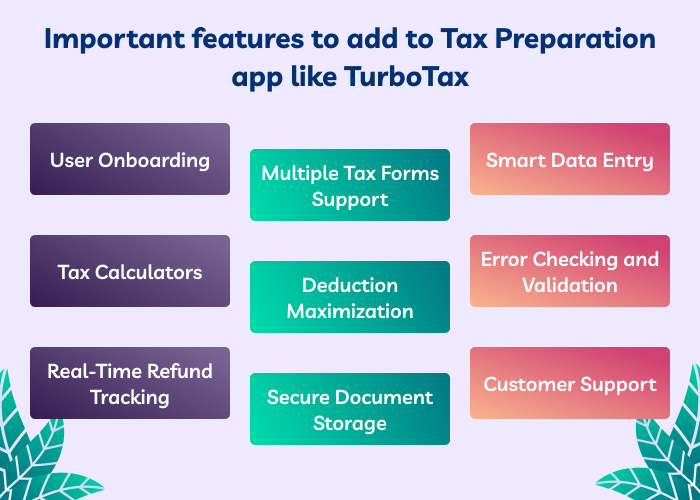

Important features to add to tax preparation app like TurboTax

A number of crucial elements must be included when developing a tax preparation software similar to TurboTax in order to guarantee a flawless user experience and correct tax filing. Here are some important features to consider:

- User Onboarding: Facilitate a seamless onboarding experience for users by guiding them through account setup, personal data entry, and tax filing status selection.

- Multiple Tax Forms Support: Provide support for a broad variety of tax forms and schedules, such as income forms, credits, deductions, and other tax-related papers, to suit different tax scenarios.

- Smart Data Entry: Reduce manual data entry and increase accuracy by using intelligent data entry capabilities that automatically fill up fields depending on user input or imported data.

- Tax Calculators: Provide built-in tax calculators for estimating tax liabilities, deductions, and credits based on user input. Display real-time updates as users enter information to help them understand their tax situation.

- Deduction Maximization: Provide advice on optimizing credits and deductions by asking consumers for pertinent data and making appropriate deduction recommendations depending on their tax situation.

- Error Checking and Validation: Incorporate error checking and validation mechanisms to identify common mistakes, missing information, or discrepancies in tax filings. Provide alerts and suggestions for resolving errors to ensure accurate tax returns.

- Real-Time Refund Tracking: Enable users to track the status of their tax refunds in real-time, providing updates on processing times, estimated refund amounts, and any issues that may delay refunds.

- Secure Document Storage: Implement secure document storage features to allow users to upload and store tax-related documents securely within the app. Utilize encryption and authentication mechanisms to protect sensitive information.

- Customer Support: Offer customer support channels such as live chat, email support, or phone assistance to address user inquiries, resolve issues, and provide personalized tax advice when needed.

Costs associated with tax preparation apps like TurboTax

- Development Team: It can be expensive to hire project managers, UI/UX designers, software engineers, and developers. Depending on their location and level of experience, developers may charge hourly fees of $55 to $150 or more.

- Design: An app must include UI/UX design, visuals, and branding elements in order to be user-friendly and aesthetically pleasing. It can cost anything from $2,000 to $10,000 or more to hire a professional designer or design team, depending on how complicated the needs are.

- Infrastructure and Hosting: Services for cloud hosting for apps like TurboTax are required for the backend infrastructure of the application. Prices might change depending on things like server resources, data storage, and bandwidth utilization. Pricing schemes based on use are available from providers such as Microsoft Azure, AWS, and Google Cloud Platform.

- Tools and Technologies: Licensing fees or subscriptions for development tools, frameworks, and libraries may incur costs depending on the technologies used in the app’s development.

- Testing and Quality Assurance: To guarantee apps like TurboTax’s speed, security, and operation, extensive testing is required. Depending on the extent of testing necessary, costs related to testing and quality assurance may include payments for automated testing tools or outside testing services.

- Maintenance and Support: Ongoing maintenance, updates, and customer support are necessary to keep the app running smoothly and address user issues. Budgeting for continuing maintenance expenses is crucial for the long-term viability of the app.

Conclusion

Carefully weighing essential features is necessary while creating a tax preparation app that is comparable to TurboTax in order to guarantee a flawless user experience and correct tax filing.

To give consumers a complete tax preparation solution, features including safe document storage, real-time refund tracking, smart data entry, tax calculators, error checking, user onboarding, support for numerous tax forms, and customer assistance are crucial.

The price of creating such an app, however, might differ based on a number of variables, including the costs of the development team, the demands for design, infrastructure, and hosting, tools and technologies utilized, testing, and continuing maintenance and support. The benefits of developing an effective and user-friendly tax preparation software may greatly enhance the tax filing process for both individuals and businesses, despite the necessary investment.

FAQs

How can I ensure the security of sensitive tax information within an app like TurboTax?

Can the tax preparation app handle complex tax scenarios and calculations?

Are there options for integrating the tax preparation app with external financial institutions or tax authorities?

How often should the tax preparation app like TurboTax be updated to reflect changes in tax laws and regulations?

Can the tax preparation app provide personalized tax advice based on individual user circumstances?

Shivangi is a passionate Copywriter at Alian Software with expertise in technical copywriting. She shares information that is easy to understand regarding business, technology, and trends.