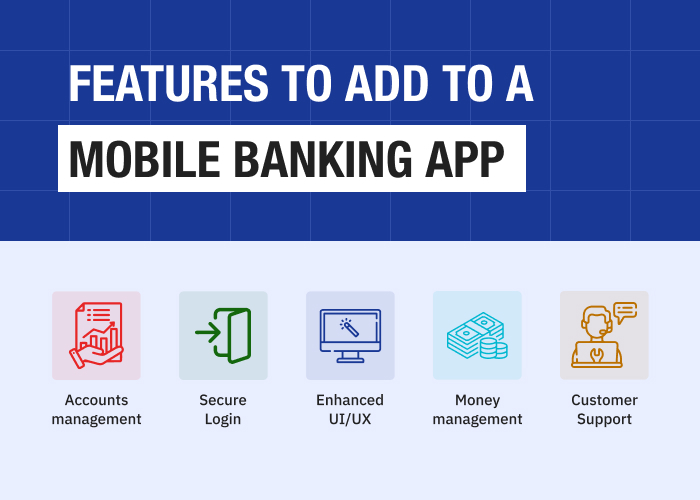

Features to add to a mobile banking app

Accounts management

Giving people immediate access to their bank accounts can be possible with this feature. Account history, pending transactions, and account balances should all be accessible to users. Furthermore, keeping track of several accounts—savings, checking, credit, etc.—increases the app’s economic portfolio.

Secure Login

To secure and safeguard user data, the banking industry needs a multi-layered authentication procedure. Using biometric identification methods, such as face or fingerprint scanning, improves the app’s legitimacy. Each of these elements greatly influences the price of creating a mobile banking app.

Enhanced UI/UX

Banking apps should place a premium on their user interface. A straightforward, clear, and aesthetically pleasing app design facilitates seamless navigation for users. A favorable client journey is ensured with accurate CTA (Call-to-Action) buttons and smooth onboarding.

Money management

Giving users access to manage their money may make a financial app stand out. Customers may make wise decisions by combining financial goal-setting, spending monitoring, and budgeting tools. Engaged users benefit from push alerts for bills, spending analysis, and customized budgets.

Customer Support

For a mobile banking app to be successful, customer service that is both responsive and reachable is essential. The user experience is improved with real-time support, FAQs (Frequently Asked Questions), and in-app chat. Users’ confidence and loyalty are fostered by the app’s prompt replies to their help queries.

Mobile banking app development cost factors

The cost of developing a mobile banking app can vary significantly based on several factors.

- Scope and Complexity: Basic functionalities such as account balance checks may cost less than advanced features like investment tracking or financial planning tools.

- Platform: Developing for a single platform (iOS or Android) is typically less expensive than creating native apps for both. Consider the target audience and market share when deciding on platform(s).

- Design Complexity: A well-designed app with an intuitive and visually appealing interface may require more design effort, impacting overall costs.

- Security Measures: Implementing robust security features, especially in the financial sector, is crucial. Advanced security measures, such as biometric authentication or encryption, may add to development costs.

- Third-Party Services: If your mobile banking app integrates with external services, APIs, or third-party tools for features like credit scoring, financial analytics, or customer support, additional costs may be incurred.

- Regulatory Compliance: Compliance with financial regulations and industry standards may require additional resources and specialized expertise.

- Testing and Quality Assurance: Rigorous testing, including security testing, performance testing, and usability testing, is essential for a mobile banking app.

- Back-End Infrastructure: The complexity of the back-end infrastructure, including server setup, database design, and data processing, can impact costs.

- Legal and Compliance Costs: It’s important to have legal experts review the app’s compliance with relevant laws.

- Maintenance and Updates: Ongoing maintenance, updates, and support post-launch are essential for a successful mobile banking app.

Lastly, the choice of development team, including in-house developers, outsourcing, or hiring freelancers, can impact costs. Rates vary based on the location and expertise of the development team.

Steps to develop banking app development

- Market Research: First, identify the target audience and their banking needs. Analyze competitors and market trends.

- Compliance and Security: Second, understand and adhere to regulatory requirements. Furthermore, implement robust security measures to protect user data and transactions.

- Choose Development Platforms: Decide on the mobile platforms (iOS, Android, or both) based on your target audience. Select development frameworks and tools compatible with chosen platforms.

- UI/UX Design: Create wireframes and prototypes for the app’s layout and navigation. Ensure a seamless and engaging user experience throughout the app.

- Development: Code the app using programming languages like Swift (iOS) or Kotlin/Java (Android). Implement backend infrastructure for data storage, processing, and communication.

- Testing: Conduct thorough testing for functionality, usability, and security. Perform compatibility testing on various devices and operating system versions.

- Deployment: Prepare for the app launch by creating marketing materials and promotional strategies. Release the app on app stores (Google Play, Apple App Store).

- Maintenance: Provide ongoing support for users. Regularly update the app to introduce new features, fix bugs, and address security concerns.

Conclusion

The route from concept to deployment of mobile banking app development requires a delicate balance between innovation, user-centric design, and strong security. Staying ahead of industry trends and user input is essential to future-proofing your app in this always-changing world. The creation of a mobile banking app is not just a technological achievement but also a commitment to rethinking the future of banking experiences in a world where financial services are readily available to us.

FAQs

What are the key features of a mobile banking app?

How long does it take to develop a mobile banking app?

How much does it cost to develop a mobile banking app?

How can I ensure the security of my mobile banking app?

What technologies are commonly used in mobile banking app development?

Ravi Bhojani is the Chief Marketing Officer (CMO) at Alian Software, where he spearheads the company’s marketing strategies and drives its brand presence in the competitive IT services landscape. With over a decade of experience in the technology and marketing sectors, Ravi has consistently demonstrated his ability to blend innovative marketing techniques with deep industry knowledge to deliver outstanding results.