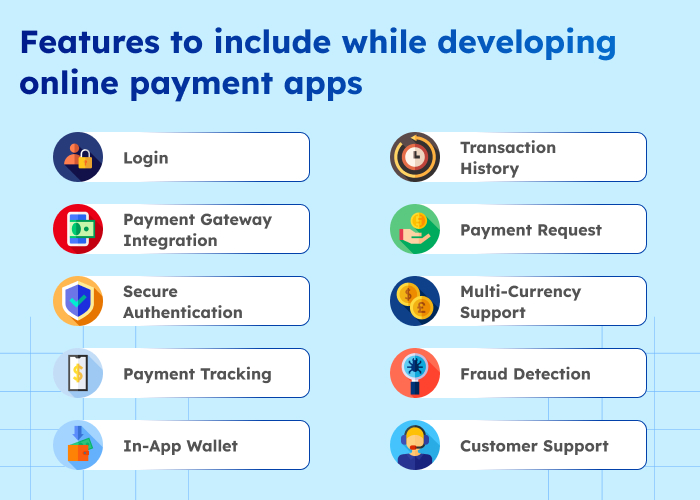

Features to include while developing online payment apps

- Login: For individualized experiences and the tracking of past transactions, let consumers register accounts or log in using their phone number.

- Payment Gateway Integration: Integrate with trustworthy payment gateways to enable easy transactions and support a range of payment options, including bank transfers, credit/debit cards, and cryptocurrency.

- Secure Authentication: To prevent unwanted access to user accounts, use strong authentication techniques such as two-factor authentication and biometric authentication.

- Payment Tracking: Give users real-time notifications and updates on the progress of their transactions, including accepted payments, pending orders, and declined orders.

- In-App Wallet: Provide users with the ability to contribute and retrieve funds securely, as well as the option to keep money within the app’s wallet for quicker and more convenient transactions.

- Transaction History: Give customers access to comprehensive transaction records that include the date, time, amount, and recipient details so they can keep tabs on their spending and handle their money well.

- Payment Request: Make it easier for users to request and receive payments by enabling them to do so via email, SMS, or in-app alerts sent to individuals or groups.

- Multi-Currency Support: By providing multi-currency compatibility, you can reach a worldwide audience and let people transact in the currency of their choice without having to worry about complicated or expensive conversions.

- Fraud Detection: To protect users and the platform from fraudulent transactions, deploy sophisticated fraud detection algorithms and security controls.

- Customer Support: Provide quick and effective assistance to users with payment-related questions, conflicts, or technical problems by integrating live chat or a dedicated hotline.

Cost to create online payment apps

Design

Graphics, branding, and UI/UX design for online payment apps are all included in design fees. The expense of hiring a professional designer or design team might range approximately from $5,000 to $20,000 or more, depending upon the complexity and extent of the design specifications.

Development

This covers the price of employing software engineers and developers to create the application. Developers might charge approximately $50 to $200 per hour or more, based on their location and level of experience. Development expenses will also be influenced by the app’s complexity and the number of platforms that it supports.

Third-party Integrations

Additional expenses, including setup, transaction, and recurring usage fees, may be incurred when integrating with payment gateways, security services, and other third-party APIs. These expenses of online payment apps may differ based on the suppliers and the quantity of transactions handled.

Security

It is crucial to make sure the app is secure, especially when managing sensitive financial data. Strong security measures like tokenization, encryption, and adherence to industry standards could need more investments in security knowledge and tools.

Testing and Quality Assurance

Ensuring the software is tested for performance, security flaws, and functionality is essential to producing a dependable and safe product. The necessary testing scope and the length of the testing phase will determine the costs associated with testing and quality assurance.

Regulatory Compliance

Adherence to financial rules and data protection legislation may include supplementary costs for legal advice, compliance evaluations, and putting the required safeguards in place to guarantee regulatory compliance.

Maintenance and Updates

To keep the app secure against new threats and vulnerabilities and operating efficiently, regular maintenance, upgrades, and support are necessary. Setting aside money for regular maintenance is essential to the app’s long-term viability.

Conclusion

In summary, a variety of considerations and expenses go into developing online payment apps, all with the goal of guaranteeing a safe, dependable, and user-friendly platform for online transactions.

For users to have a flawless payment experience, every component—from design and development to integration, security, and continuous maintenance—needs to be carefully considered and financially supported.

Even while there may be significant up-front costs, offering consumers accessibility, security, and convenience can have long-term advantages that greatly exceed those costs.

Businesses may create online payment apps with confidence, knowing they are laying the groundwork for future development and success in the digital economy, by comprehending the different expenses involved and prioritizing critical features and functions.

FAQs

How long does it typically take to develop an online payment app from start to finish?

Are there any specific regulations or compliance standards that online payment apps need to adhere to?

What measures are taken to ensure the security of user data and transactions within the app?

Can online payment apps support recurring payments for subscription-based services?

What steps are involved in integrating multiple payment gateways into an online payment app, and how does it impact overall development costs?

Ravi Bhojani is the Chief Marketing Officer (CMO) at Alian Software, where he spearheads the company’s marketing strategies and drives its brand presence in the competitive IT services landscape. With over a decade of experience in the technology and marketing sectors, Ravi has consistently demonstrated his ability to blend innovative marketing techniques with deep industry knowledge to deliver outstanding results.